Compound interest is the practice of earning interest on both your original principal and on the accumulated interest itself. In other words, you earn “interest on interest” over time investopedia.comrocketmortgage.com. This effect means your balance grows faster as time goes on. As one expert puts it, compounding happens when “earnings on your savings are reinvested to generate their own earnings…Over time, compounding can add a lot of value because you have more earnings and those earnings are ‘earning earnings’”hermoney.com. In fact, compound interest can be so powerful that it’s often called “the eighth wonder of the world”wealth.visualcapitalist.com. Understanding how it works is essential for anyone looking to grow savings or investments (and for managing debt).

How Compound Interest Works

Compound interest multiplies your money at an accelerating rate. In the early stages, growth may seem slow, but as interest accumulates, it kicks in on itself. For example, if you start with $1,000 at 5% annual interest, after one year you’d have $1,050. In the next year, however, you earn 5% on $1,050, not $1,000 – so you get $52.50 that year, ending with $1,102.50. Each year the interest earned increases slightly as your balance grows. Investopedia notes that compound interest “multiplies your money at an accelerated rate”investopedia.com. The longer you leave money invested, the more pronounced this effect becomes.

Compound interest works for both savings and loans – but with opposite effects. If you’re saving or investing, compound interest is your friend: the interest you earn keeps adding to the balance, generating even more interest later. But for debt, compounding can work against you. For example, on loans “repaying the loan takes more time” with compound interest, because you owe interest on previously accrued interestrocketmortgage.com. In practice, this means you should aim to let savings compound for as long as possible, and try to minimize compound interest on any debt.

Key Points About Compounding

- Interest on Interest: With compounding, you earn interest on both your original principal and on any interest already earnedrocketmortgage.com. This is what makes compound interest grow faster than simple interest (which only pays on the principal).

- Frequency Matters: The more frequently interest is compounded (for example, monthly or daily versus yearly), the more interest you earn. Investopedia explains that “the higher the number of compounding periods, the larger the effect of compounding”investopedia.com. For instance, monthly compounding yields more total interest than annual compounding at the same nominal rate.

- Time Horizon: Time is your greatest ally with compound interest. Even a modest interest rate can produce large gains given enough years. As Investopedia shows, a $100,000 deposit at 5% simple interest earns $50,000 in 10 years, but with monthly compounding at 5% it earns about $64,700 in the same periodinvestopedia.com. That extra $14,700 comes purely from the “interest on interest” effect.

- Savings vs. Debt: Compound interest accelerates wealth-building but also can accelerate debt growth. As Rocket Mortgage notes, compound interest on savings “receives interest payments that will turn into higher payments with each successive period,” while on loans it “means the interest you pay builds upon itself”rocketmortgage.com. In practice, let your savings compound and pay extra on high-interest loans to avoid big interest charges.

Compound Interest in Action

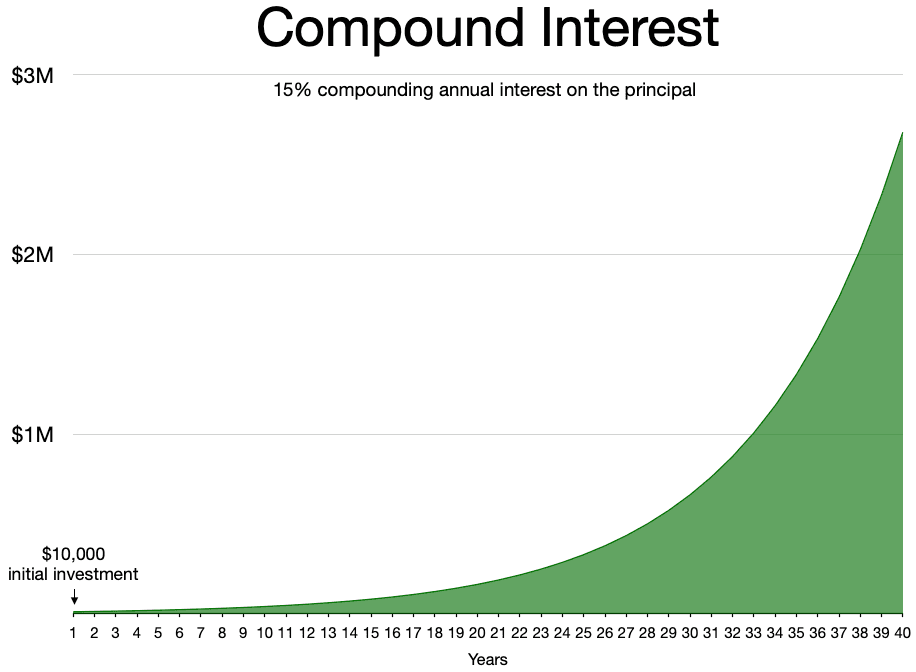

Consider this real-world scenario: a $10,000 investment at a very high 15% annual rate, compounded yearly, over 40 years. The chart above (from Wikimedia Commons) illustrates the result – growth is slow in early years, but explodes after a few decades. By year 40, that investment approaches $3 million. This dramatic example (15% compounding on $10,000 over 40 years) highlights the sheer power of compound interestcommons.wikimedia.org. Even at lower rates, leaving money invested for many years produces large gains. The key takeaway: time and compound interest together produce exponential growth. Short-term returns may look modest, but every extra year makes the balance multiply that much more.

Tips to Maximize Compound Interest

- Start Early: The sooner you start saving or investing, the longer your money has to compound. Even small contributions made early can grow much larger than the same amounts invested laterhermoney.com. Time is one of the best advantages in finance.

- Reinvest All Earnings: Leave interest and dividends in the account. By reinvesting all earnings instead of spending them, you let each new dollar continue to earn additional interest.

- Choose Frequent Compounding: If you have options, pick accounts or investments that compound interest more often (daily or monthly instead of annually). More frequent compounding will slightly increase your total returns over timeinvestopedia.com.

- Avoid High-Interest Debt: Because interest on loans compounds against you, focus on paying down debts (like credit cards) that compound daily or monthlyrocketmortgage.com. Reducing principal faster means you pay less in total interest.

- Be Patient: Compound interest rewards patience. Avoid the temptation to withdraw early. Every year you leave funds untouched allows “interest on interest” to accumulate more value.