Introduction

President Donald Trump is preparing to introduce his most significant round of tariffs, marking a major shift in U.S. trade policy. Since returning to the White House, Trump has already imposed tariffs on steel, aluminum, automobiles, and various imports from Canada, Mexico, China, and the European Union. However, the most anticipated move—reciprocal tariffs—will officially take effect on April 3, aimed at reducing the country’s $1.2 trillion trade deficit.

With this sweeping policy change, the U.S. economy faces potential consequences, ranging from rising consumer costs to strained international relations. Here’s what to expect as the tariff implementation nears.

Understanding Reciprocal Tariffs

Reciprocal tariffs are designed to counterbalance trade fees imposed on U.S. exports by foreign countries. Under this plan, the U.S. will apply equal tariffs on imports from nations that currently charge duties on American goods.

In February, Trump signed a memorandum directing trade officials to compile a list of countries and their respective tariff rates. This initiative aims to create a fairer trade environment by ensuring that the U.S. is not subjected to higher fees without reciprocation.

The Reason Behind Trump’s Tariff Push

Trump argues that these tariffs will encourage domestic manufacturing by discouraging companies from importing goods from countries with high duties on U.S. products.

In 2024, the U.S. trade deficit reached a record $1.2 trillion, largely due to the imbalance between imports and exports. By implementing reciprocal tariffs, the administration seeks to protect American industries from what it considers unfair foreign trade practices.

Trump has consistently voiced concerns about other nations imposing high tariffs on American goods without consequences. He believes that by leveling the playing field, the U.S. can boost its own industries while reducing dependency on foreign manufacturing.

Who Are the ‘Dirty 15’?

Treasury Secretary Scott Bessent recently revealed that the new tariffs will primarily target the 15% of countries contributing the most to the U.S. trade deficit. These nations, dubbed the “Dirty 15,” reportedly impose significant tariffs on American goods while enjoying relatively free access to U.S. markets.

While the White House has not yet released an official list, reports suggest that key countries impacted could include:

- China

- European Union

- Mexico

- Vietnam

- Taiwan

- Japan

- South Korea

- Canada

- India

- Thailand

- Switzerland

- Malaysia

- Indonesia

- Cambodia

- South Africa

A Narrower Scope for Tariffs?

Despite initially proposing broad-based tariffs, the Trump administration appears to be refining its approach. Recent reports indicate that some previously suggested tariffs—such as those on semiconductors, pharmaceuticals, and microchips—may not be included in the upcoming wave of duties.

Trump has yet to confirm whether life-saving medicines will be exempt from the new tariffs, adding to the uncertainty surrounding the administration’s final decision. The unpredictability of Trump’s trade policy has created a volatile environment, with some industries bracing for impact while others hope for a last-minute reversal.

A Shift in Trump’s Tone

Trump’s rhetoric on tariffs has noticeably softened in recent weeks. After previously hyping the policy as a necessary measure to protect American interests, he now insists the new tariff rates will be “very lenient” compared to expectations.

At a recent press conference, Trump stated, “I think people are going to be very surprised. It’ll be, in many cases, less than the tariff that they’ve been charging us for decades.” This shift suggests that while the administration remains committed to the plan, it may be willing to scale back its severity to prevent economic disruption.

Economic Concerns and Recession Fears

Economists have expressed growing concern that large-scale reciprocal tariffs could harm an already fragile economy. Tariffs are essentially taxes on imports, and companies often pass these costs down to consumers.

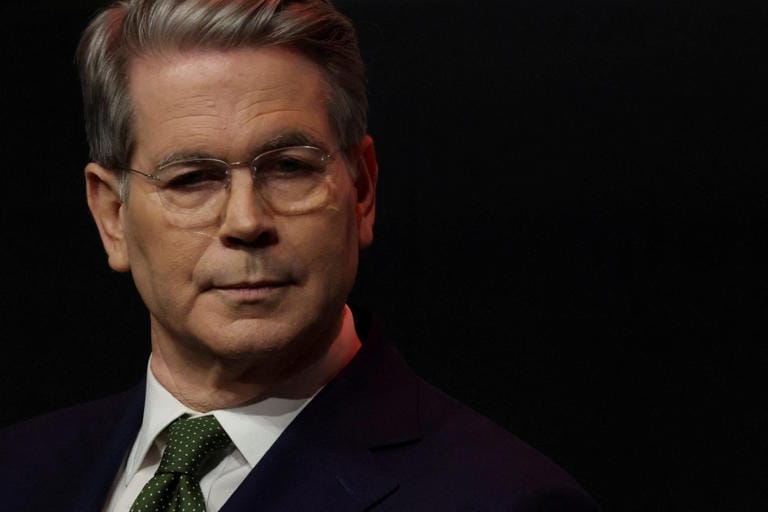

According to Mark Zandi, chief economist at Moody’s, prolonged tariff enforcement could push the U.S. to the brink of recession. He highlighted several key risks:

- Increased costs for low- and middle-income consumers

- Additional financial burdens on U.S. businesses

- Retaliatory tariffs from affected countries

- Stock market instability impacting overall wealth and spending

Zandi predicted that if the tariffs remain in place for an extended period, the U.S. could experience significant economic strain. However, he also speculated that political pressure might force the administration to eventually scale back or eliminate the tariffs.

Wall Street Reacts to ‘Liberation Day’ Tariffs

As Trump prepares to enforce what he calls “Liberation Day” tariffs, the stock market has already responded negatively. On Friday, the Dow Jones Industrial Average dropped over 700 points, marking its largest decline since March 10. The S&P 500 also fell by more than 100 points.

These declines were triggered by investor concerns over inflation and the long-term impact of tariffs on major industries. The uncertainty surrounding Trump’s trade policies has caused market fluctuations, erasing many of the gains made following his election victory.

Global Response and Potential Trade War Escalation

Many countries affected by the tariffs have already signaled their intent to retaliate.

- China and Canada have announced new duties on U.S. exports in response to previous tariff measures.

- The European Union has warned that it will introduce counter-tariffs next month.

- Canadian Prime Minister Mike Carney declared that the U.S. is “no longer a reliable trade partner” and vowed to seek stronger economic ties with other nations.

The Canada-United States-Mexico Agreement (CUSMA) will provide some protection for the auto industry, but foreign-made parts will still be subject to tariffs. Despite this, Canada has promised to retaliate in full force.

How Will Trump Respond to Retaliation?

Trump has made it clear that any retaliatory tariffs from other countries will be met with further action from the U.S.

“Many countries have taken advantage of us for decades,” Trump said. “That has to stop.”

However, despite his firm stance, Trump claimed he had a “very good” conversation with Canada’s Prime Minister regarding trade relations. He also suggested that many world leaders privately admit that the U.S. has been treated unfairly in trade agreements.

Conclusion

Trump’s latest tariff plan represents a bold step in reshaping global trade policies, but it comes with significant risks. While the administration argues that these tariffs will strengthen American industries, economists warn of potential economic hardships, including increased consumer costs and market instability.

As the world braces for the fallout, the coming weeks will determine whether Trump’s trade strategy leads to economic gains or further tensions with international partners. Only time will tell whether these tariffs serve as a strategic advantage or a major misstep in global trade relations.