A Critical Deadline Looms: Act Now to Protect Your Finances

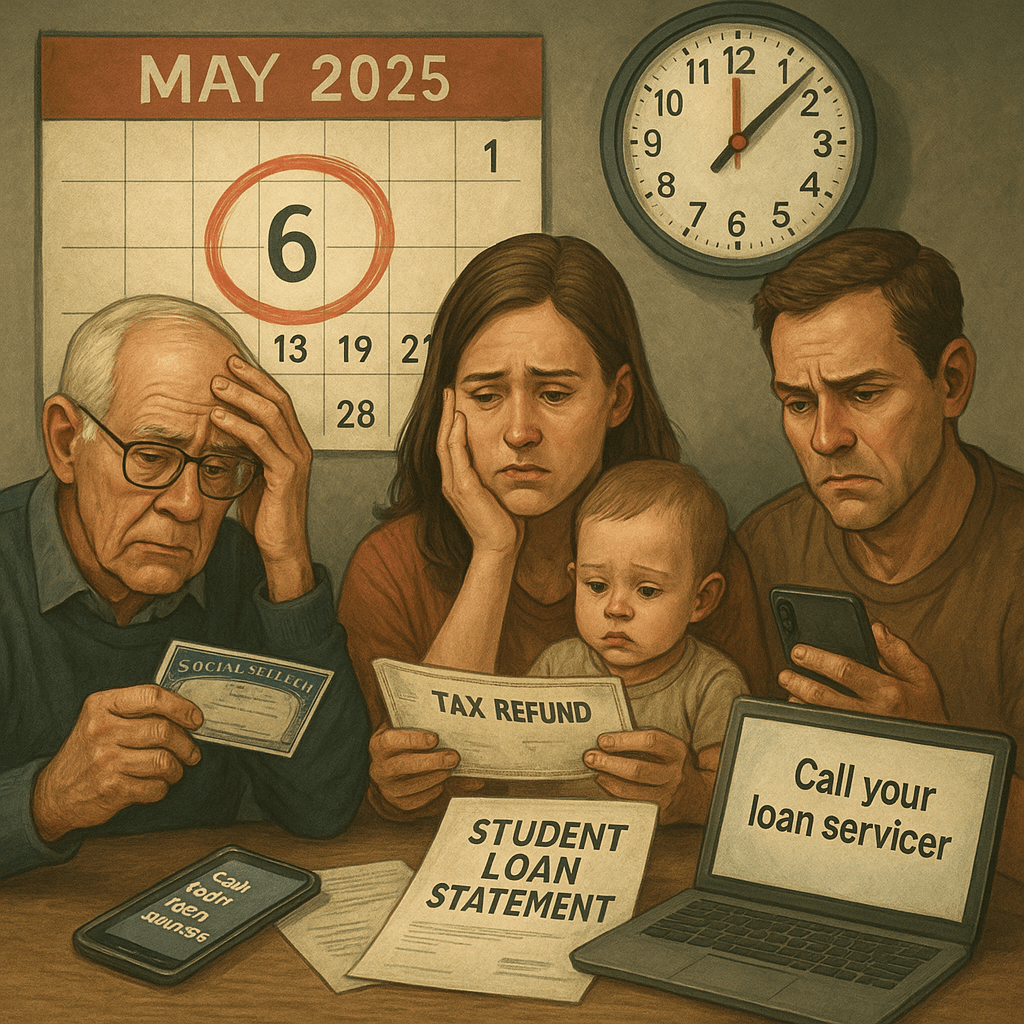

Imagine checking your bank account, expecting a tax refund, only to find it’s been taken to pay an old student loan you couldn’t afford. Or worse, seeing your Social Security check shrink just when you need it most. For millions of Americans, this could become reality starting May 7, 2025, unless they take action by May 6. The U.S. Department of Education has issued a stark warning: borrowers in default on federal student loans—those who haven’t paid in over 270 days—face garnishment of their Social Security benefits and tax refunds if they don’t enroll in a repayment plan soon. Let’s break down what’s happening, why it matters, and how you can avoid this financial hit.

The Stakes: What Happens in Default?

When you miss payments on a federal student loan for 270 days, it enters default, triggering serious consequences. The government can:

- Garnish Wages: Take up to 15% of your disposable income without a court order.

- Offset Tax Refunds: Seize your federal and state tax refunds to cover the debt.

- Reduce Social Security Benefits: For borrowers over 62, up to 15% of benefits can be taken, though a minimum amount (about $750/month) is protected ([Federal Student Aid]([invalid url, do not cite])).

With an estimated 5 million borrowers in default—part of the 43 million Americans owing $1.7 trillion in student debt—these actions could affect a huge swath of the population, from retirees to young professionals ([Forbes]([invalid url, do not cite])). For someone like Maria, a 65-year-old retiree relying on Social Security, losing even a small portion could mean skipping groceries or meds. For a young parent expecting a tax refund, it could derail plans to cover rent or childcare.

Why Now? The May 6 Deadline Explained

On March 15, 2025, the Department of Education announced a new push to enforce collections, setting a deadline of May 6, 2025, for defaulters to enter repayment plans or face immediate garnishment starting May 7 ([Ed.gov News]([invalid url, do not cite])). This move follows the end of the COVID-19 payment pause in 2023, which gave borrowers a break but left many struggling to resume payments. The pause’s aftermath saw default rates climb, prompting the government to act.

The timing—early May—aligns with post-tax season, when refunds are processed, making it a prime window for offsets. The policy aims to recover funds amid a $1.7 trillion student debt crisis, but critics argue it’s harsh, especially for low-income or elderly borrowers. “This feels like punishing people already drowning,” says Sarah, a debt counselor in Chicago. Others, like policy analyst Mark Thompson, defend it: “The government’s signaling accountability—taxpayers shouldn’t foot the bill forever” ([CNN Opinion]([invalid url, do not cite])). The debate rages, but the deadline is real.

Steps to Take Before It’s Too Late

Don’t panic—there’s still time to act. Here’s what you can do by May 6:

1. Contact Your Loan Servicer

- Find your servicer through the [Federal Student Aid]([invalid url, do not cite]) website or by calling 1-800-4-FED-AID.

- Discuss your situation and ask about repayment options. Be honest about your finances—they’re there to help.

2. Explore Repayment Plans

- Income-Driven Repayment (IDR): Caps payments at 5-20% of your discretionary income, based on plans like SAVE or PAYE ([Ed.gov IDR Plans]([invalid url, do not cite])).

- Standard Repayment: Fixed payments over 10-30 years, if affordable.

- IDR plans can prevent default and make payments manageable, even if you’re on a tight budget.

3. Consider Loan Rehabilitation

- Make nine on-time payments over 10 months to remove default status.

- Payments are often as low as $5/month, based on income ([Federal Student Aid]([invalid url, do not cite])).

- This restores eligibility for benefits like deferment and forgiveness.

4. Look into Loan Consolidation

- Combine defaulted loans into a new Direct Consolidation Loan, resetting your status ([Ed.gov Consolidation]([invalid url, do not cite])).

- It’s quicker than rehabilitation but may not restore all benefits.

5. Seek Expert Help

- Nonprofits like the [National Foundation for Credit Counseling]([invalid url, do not cite]) offer free or low-cost student loan counseling.

- Avoid for-profit debt relief companies, which often charge high fees for services you can get free ([Consumer Financial Protection Bureau]([invalid url, do not cite])).

Time is short, so don’t delay. “I waited too long and lost my refund last year,” says John, a 40-year-old teacher. “Call your servicer—it’s easier than you think.”

The Bigger Picture: Impact and Controversy

This deadline could hit hard, especially for older borrowers on Social Security or low-income families counting on tax refunds. Data suggests over 1 million seniors have student debt, with many facing benefit cuts ([AARP]([invalid url, do not cite])). For younger borrowers, losing a refund could mean missing rent or car payments, deepening financial stress.

The policy’s fairness is hotly debated. Supporters argue it’s necessary to manage the $1.7 trillion debt burden, ensuring borrowers contribute. Critics, including advocacy groups like [Student Debt Crisis Center]([invalid url, do not cite]), call it punitive, noting many defaulters are already struggling. “Garnishing benefits from retirees isn’t justice—it’s cruelty,” says advocate Lisa Brown. Posts on X reflect mixed sentiments, with some users urging forgiveness, others demanding accountability ([X Post]([invalid url, do not cite])). The controversy underscores a broader tension: balancing debt recovery with compassion.

Resources to Navigate the Crisis

Don’t face this alone—help is out there:

- Federal Student Aid Website: Offers tools to check loan status and explore options ([Federal Student Aid]([invalid url, do not cite])).

- Loan Simulator: Helps you compare repayment plans ([Ed.gov Loan Simulator]([invalid url, do not cite])).

- Nonprofit Counseling: Groups like NFCC and [American Consumer Credit Counseling]([invalid url, do not cite]) provide free advice.

- Hotline: Call 1-800-4-FED-AID for immediate support.

Act Now to Secure Your Future

With just two weeks until May 6, 2025, the clock is ticking for millions of student-loan borrowers. Losing Social Security benefits or tax refunds could make life harder, but you have options. Reach out to your servicer, explore repayment plans, or seek free counseling to get back on track. This deadline is a wake-up call, but it’s also a chance to take control. Don’t let default define your financial future—act today, and breathe a little easier tomorrow.

| Action | Details | Deadline |

|---|---|---|

| Contact Loan Servicer | Discuss repayment options with your servicer | May 6, 2025 |

| Enroll in IDR Plan | Cap payments based on income | May 6, 2025 |

| Start Loan Rehabilitation | Make 9 payments to remove default status | May 6, 2025 |

| Consolidate Loans | Combine loans to reset status | May 6, 2025 |

| Seek Nonprofit Counseling | Get free advice from NFCC or similar groups | As soon as possible |