The US economy has long been a global powerhouse, driven by a mix of private enterprise and government intervention. However, recent statements by the US Treasury Secretary about the need to “re-privatize” the US economy have sparked intense debate. This article delves into the implications of this statement, exploring what it means for the private sector, the role of government, and the broader global economic landscape. We’ll also analyze the concerns raised by critics, including the BRICS nations, and examine how this shift could reshape the future of the US economy.

What Is the Private Sector and Why Does It Matter?

Before diving into the analysis of the US Treasury Secretary’s statement, it’s essential to understand what is the private sector. The private sector comprises businesses and organizations that are not owned or controlled by the government. These entities operate for profit and are driven by market forces, competition, and innovation. Historically, the private sector has been the backbone of the US economy, driving growth, creating jobs, and fostering technological advancements.

However, the line between the public and private sectors has blurred in recent decades. Government interventions, subsidies, and contracts have increasingly influenced private enterprises, raising questions about the true independence of the private sector. This brings us to the core of the US Treasury Secretary’s argument: the need to “re-privatize” the US economy.

The US Treasury Secretary’s Statement: A Call to Re-Privatize

The US Treasury Secretary’s statement about the need to “re-privatize” the US economy highlights a growing concern: the over-reliance on government support and intervention in key industries. According to the Secretary, the US economy has become too dependent on government contracts, subsidies, and monetary policies, undermining the principles of free-market capitalism.

Key Points from the Statement:

- Government Overreach: The US Treasury Secretary argues that industries like defense, energy, and technology have become quasi-public sectors, with government contracts dictating their operations.

- Monetary Policy: The Federal Reserve’s low-interest-rate policies and quantitative easing have artificially propped up corporations, creating a distorted economic landscape.

- Environmental Hypocrisy: The US has outsourced pollution to other countries while maintaining a clean domestic environment, raising questions about its commitment to global environmental goals.

This analysis of the US Treasury Secretary about the need to “re-privatize” the US economy underscores the challenges of maintaining a balanced economic model in an era of increasing government intervention.

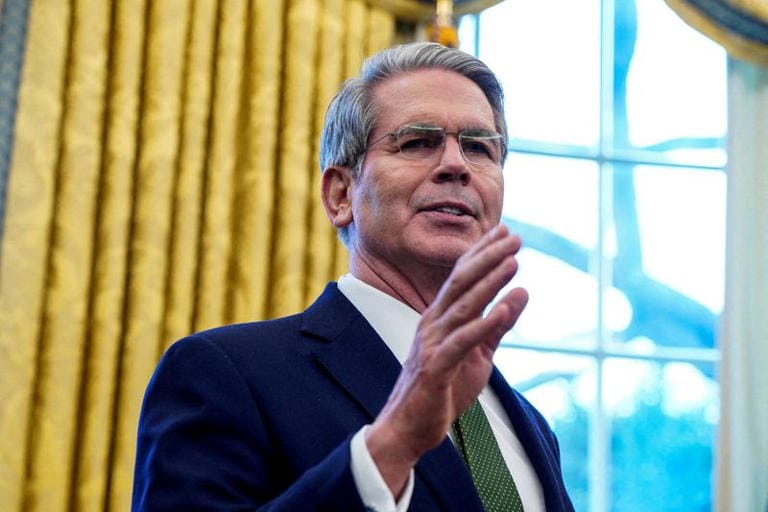

The Role of Scott Bessent and His Perspective

While the US Treasury Secretary’s statement has garnered significant attention, it’s worth noting the perspective of influential figures like Scott Bessent, a prominent investor and economic strategist. Bessent has long advocated for a return to free-market principles, arguing that excessive government intervention stifles innovation and competition.

Scott Bessent’s Key Arguments:

- Market Discipline: Bessent believes that the private sector thrives when it operates without government “babysitting,” as he calls it.

- Global Competitiveness: He warns that the US risks losing its competitive edge if it continues to rely on government support rather than fostering genuine innovation.

- Monetary Policy Concerns: Bessent has criticized the Federal Reserve’s policies, arguing that they create artificial bubbles and distort market signals.

By aligning with the US Treasury Secretary’s call to “re-privatize” the US economy, Scott Bessent highlights the urgent need for economic reform.

The Blurred Lines Between Public and Private Sectors

One of the central themes in the analysis of the US Treasury Secretary about the need to “re-privatize” the US economy is the blurred line between the public and private sectors. This phenomenon is particularly evident in industries like defense, energy, and technology.

Examples of Government Influence:

- Defense Sector: Companies like Lockheed Martin and Boeing rely heavily on Department of Defense contracts, making them quasi-public entities.

- Energy Sector: Government policies and subsidies have shaped the energy market, from fossil fuels to renewables.

- Technology Sector: Companies like SpaceX receive significant government funding for NASA collaborations, raising questions about their independence.

This interdependence has led to a situation where the private sector is no longer purely private, prompting calls for reform.

The Global Implications of US Economic Policies

The US Treasury Secretary’s statement about the need to “re-privatize” the US economy has far-reaching implications, not just domestically but globally. The US dollar’s status as the global reserve currency and the country’s economic dominance have allowed it to shape global trade and finance. However, this model is increasingly being challenged.

Key Global Concerns:

- Dollar Dependency: Countries like Saudi Arabia and China are wary of holding dollar reserves, as US monetary policies erode the currency’s value.

- Environmental Justice: The BRICS nations accuse the US of outsourcing pollution while criticizing other countries for environmental degradation.

- Economic Inequality: The US’s consumption-driven model has created global imbalances, with developing nations bearing the brunt of environmental and social costs.

The analysis of the US Treasury Secretary about the need to “re-privatize” the US economy highlights the need for a more equitable and sustainable global economic system.

The Path Forward: Re-Privatizing the US Economy

So, what does it mean to “re-privatize” the US economy, and how can it be achieved? The US Treasury Secretary’s statement suggests a return to free-market principles, with less government intervention and more reliance on market forces.

Steps to Re-Privatize:

- Reduce Government Subsidies: Gradually phase out subsidies and let market forces determine the winners and losers.

- Reform Monetary Policy: Shift away from low-interest-rate policies and quantitative easing to restore market discipline.

- Encourage Innovation: Foster a business environment that rewards innovation and competition rather than reliance on government contracts.

- Address Environmental Concerns: Take responsibility for domestic pollution and reduce reliance on global supply chains that externalize environmental costs.

- Strengthen Global Partnerships: Work with other nations to create a more equitable and sustainable global economic system.

By taking these steps, the US can address the concerns raised in the analysis of the US Treasury Secretary about the need to “re-privatize” the US economy.

Conclusion: A Call to Action

The analysis of the US Treasury Secretary about the need to “re-privatize” the US economy highlights critical challenges facing the US and the global economy. From the blurred lines between the public and private sectors to the environmental and social costs of the current economic model, there is an urgent need for reform.

As we move forward, it’s essential to strike a balance between government intervention and free-market principles. By fostering innovation, reducing reliance on subsidies, and addressing global concerns, the US can reclaim its position as a leader in the global economy.

Call to Action: What are your thoughts on the US Treasury Secretary’s statement? Do you believe the US economy needs to be re-privatized? Share your views in the comments below and join the conversation about the future of the US and global economy.