It’s been a whirlwind week for global markets, and the fallout from President Donald Trump’s sweeping tariff announcements is only intensifying. As of this morning, April 4, 2025, at 7:15 AM PDT, the world is grappling with the ripple effects of Trump’s aggressive trade policies, with China delivering a sharp counterpunch and U.S. stock markets reeling from their worst day in years. Here’s a look at the latest developments, the economic stakes, and what might come next.

A Rough Thursday for Wall Street—and It’s Not Over Yet

Yesterday marked a grim milestone for U.S. markets, with the S&P 500 plummeting nearly 5%—its steepest drop since June 2020. The Dow Jones Industrial Average shed 1,200 points, a 2.8% decline, while the Nasdaq took an even harder hit, falling 4.5%. Tech giants like Apple, Nvidia, and Tesla saw significant losses, with Apple’s stock tumbling nearly 10% and Tesla sliding 4.5%. The trigger? Trump’s unveiling of hefty new tariffs on virtually all U.S. trading partners, a move he’s dubbed “Liberation Day” for American economic policy.

The tariffs include a universal 10% levy on all imports, set to take effect early tomorrow, Saturday, April 5. But that’s just the baseline. Trump has layered on additional “reciprocal” tariffs for specific countries, with China facing a staggering 34% on top of existing 20% duties, bringing the total to 54%. The European Union is looking at 20%, Japan 24%, and Vietnam a punishing 46%. These rates, which Trump claims are meant to level the playing field, have instead sent shockwaves through global markets, with investors bracing for higher costs and disrupted supply chains.

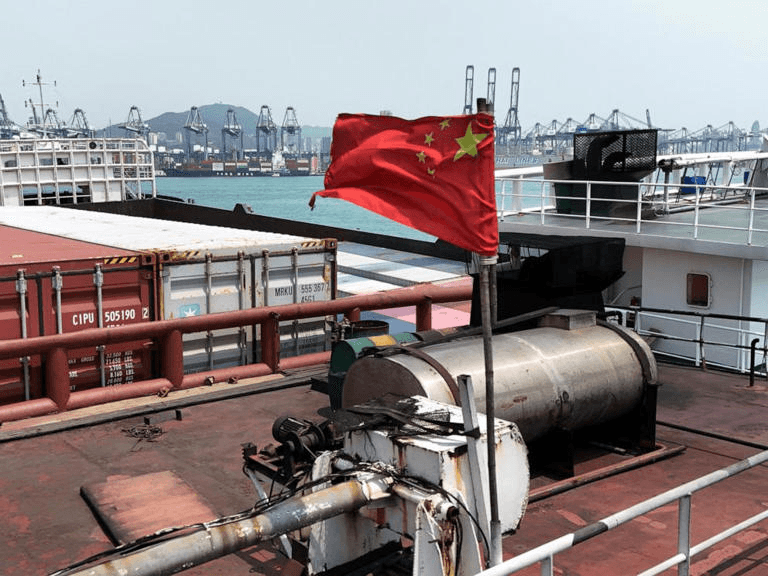

China Strikes Back: A 34% Tariff on American Goods

China didn’t waste time responding. This morning, Beijing announced it will impose a 34% tariff on all U.S. goods starting April 10, matching the additional rate Trump slapped on Chinese imports. The move fulfills China’s earlier promise to retaliate, escalating what’s already shaping up to be a full-blown trade war between the world’s two largest economies.

China’s State Council Tariff Commission didn’t mince words, calling the U.S. tariffs “a typical unilateral bullying practice” that violates international trade rules and “seriously damages China’s legitimate rights and interests.” A spokesperson from the Chinese Ministry of Commerce urged the U.S. to scrap the tariffs immediately and resolve disputes through “equal dialogue,” warning that the measures threaten “global economic development and the stability of the supply chain.” Beyond tariffs, China also added 11 American companies to its “unreliable entity list,” imposed export controls on 16 U.S. firms, and launched anti-dumping investigations into American medical imaging equipment.

The timing couldn’t be worse for China, which is already grappling with a slowing economy. Analysts estimate this trade escalation could shave up to 2.5 percentage points off China’s 2025 growth, a significant blow as the country targets a 5% expansion. For American businesses, the retaliatory tariffs mean higher costs for exports to China—a market worth $164 billion last year, up from $154 billion in 2017 before the first Trump-era trade war began.

Trump to Investors: “A Great Time to Get Rich”

Amid the market chaos, President Trump took to his social media platform this morning with a message for investors. “TO THE MANY INVESTORS COMING INTO THE UNITED STATES AND INVESTING MASSIVE AMOUNTS OF MONEY, MY POLICIES WILL NEVER CHANGE. THIS IS A GREAT TIME TO GET RICH, RICHER THAN EVER BEFORE!!!” he wrote. While he didn’t specify which policies he meant, the timing suggests he’s doubling down on his tariff strategy, framing it as a golden opportunity for wealth creation.

Trump’s optimism stands in stark contrast to the market’s reaction. His tariffs aim to boost U.S. manufacturing and address trade imbalances, but critics argue they’re more likely to fuel inflation, disrupt global supply chains, and hurt American consumers. The closure of the “de minimis” loophole—previously allowing duty-free imports under $800—will also hit e-commerce giants like Shein and Temu hard, potentially raising prices for budget-conscious shoppers.

Rubio’s Take: Markets Will Adjust, But They’re Crashing Now

Secretary of State Marco Rubio, speaking at a NATO meeting in Brussels, acknowledged the market turmoil but pushed back against claims of an economic downturn. “So I don’t think it’s fair to say economies are crashing,” Rubio said. “Markets are crashing because markets are based on the stock value of companies who today are embedded in modes of production that are bad for the United States.” He argued that businesses will adapt once they understand the new “rules” of trade, but for now, the uncertainty is driving volatility.

Rubio’s comments echo a broader sentiment within the Trump administration: short-term pain for long-term gain. But with global stocks tumbling—Japan’s Nikkei 225 fell nearly 2% in early trading today, and European markets saw sharp declines yesterday—the “adjustment” period could be a rough ride. Some analysts are even penciling in U.S. economic growth of just 1% this year, half of earlier projections, as fears of a global recession loom.

A Global Trade War Looms as Others Weigh Responses

China isn’t the only country reacting. The European Union, facing a 20% tariff, is divided on how to respond—French President Emmanuel Macron has called for a freeze on U.S. investments, while others, like Ireland and Italy, hesitate to escalate tensions. Japan’s Prime Minister Shigeru Ishiba called the tariffs a “national crisis,” with Tokyo’s stock market on track for its worst week in years. Vietnam, hit with a 46% tariff, is pleading for negotiations, while South Korea has ordered emergency support for its industries.

The tariffs are already reshaping global alliances. East Asian economies like Japan, South Korea, and Taiwan may pivot toward China to offset losses, potentially strengthening Beijing’s hand despite the trade war. Meanwhile, the U.S.’s protectionist stance risks alienating allies and undermining the global free trade order it helped build after World War II, as some experts warn.

What’s Next for Consumers and the Economy?

For everyday Americans, the impact is likely to hit soon. Economists predict higher prices for everything from groceries to electronics as companies pass on the cost of tariffs. An iPhone, heavily reliant on Chinese manufacturing, could cost $2,300 if the full burden is passed to consumers. U.S. farmers, already burned by Trump’s first-term trade wars, face new hurdles with China’s tariffs on agricultural goods. On the flip side, some investors are betting on fast-food chains, expecting consumers to trade down to cheaper meals as wallets tighten.

Trump’s universal 10% tariff kicks in tomorrow, with the steeper reciprocal rates, like China’s 34%, starting April 9. The coming days will be critical as markets digest China’s retaliation and other countries finalize their responses. Will Trump’s gamble revive American manufacturing, or will it spark a global trade war that leaves everyone worse off? For now, the world is holding its breath—and investors are bracing for more turbulence.