It’s a rough morning for anyone dreaming of a new car. As of early Thursday, April 3, 2025, a steep 25% tariff on imported vehicles—think cars, SUVs, minivans, cargo vans, and light trucks—officially took effect in the United States. This move, part of President Donald Trump’s escalating trade strategy, has sent shockwaves through global markets and left international leaders scrambling to respond. For everyday Americans, it’s a change that could hit where it hurts: the wallet.

The White House says about half of the 16 million vehicles bought in the U.S. last year came from overseas. With these new tariffs in place, experts are warning that prices could jump by thousands of dollars. That’s not just for shiny new imports either—used car prices might creep up too, as the market adjusts to the ripple effects. And it’s not stopping at vehicles: tariffs on key auto parts like engines and electrical components are slated to roll out soon, adding more pressure to an already stretched industry.

Trump’s Vision: Liberation or Disruption?

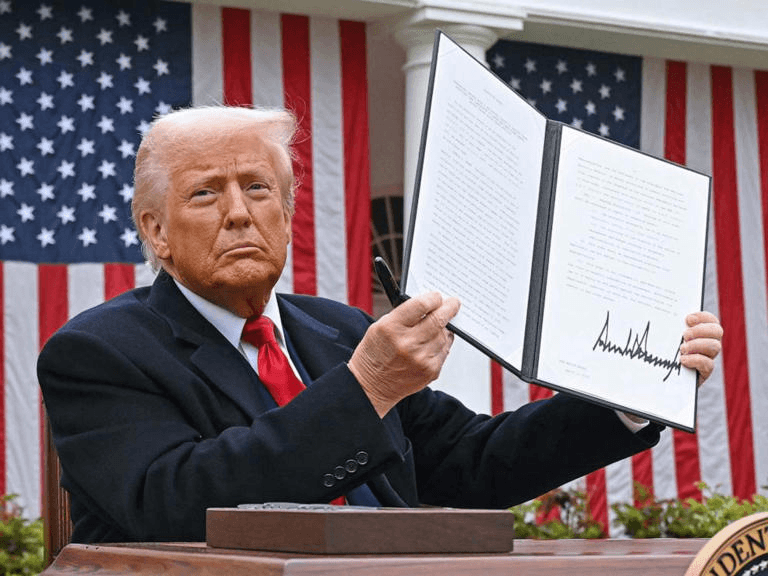

Trump announced this latest salvo just hours before the auto tariffs kicked in, speaking from the White House Rose Garden on Wednesday, April 2. “My fellow Americans, this is Liberation Day,” he declared, framing the tariffs as a bold step to break the U.S. free from reliance on foreign goods. The administration argues that excessive imports have weakened the American auto industry, threatening both national security and economic resilience. Their fix? A 25% tax on imported vehicles and parts, plus a broader plan that slaps “reciprocal” tariffs on countries taxing U.S. exports—34% on China, 20% on the European Union, and a baseline levy on everyone else.

For Trump, it’s about bringing jobs back home and boosting U.S. manufacturing. But the reality for consumers might feel less like liberation and more like a squeeze. Analysts estimate that these tariffs could tack on anywhere from $3,000 to $6,000 to the cost of a new car, depending on where it’s made and how many imported parts it uses. That’s a big deal when you consider the average new car already hovers around $49,000—a price tag that’s tough enough for many families to swallow.

Markets and Allies Reel

The timing of Trump’s announcement—after Wednesday’s market close—didn’t soften the blow. Stock futures tanked overnight: the Dow Jones Industrial Average dropped 1,100 points (2.7%), S&P 500 futures slid 3.9%, and Nasdaq-100 futures fell 4.7%. It’s a sign that investors are rattled, and not just in the U.S. This isn’t a small tweak—it’s a seismic shift, with echoes of the Smoot-Hawley Tariff Act of 1930, a Depression-era policy that two Cato Institute experts say deepened economic woes by choking trade. They’re not mincing words: Trump’s tariffs are pushing us toward levels not seen in nearly a century.

Across the globe, leaders aren’t hiding their frustration. China’s Ministry of Commerce fired back, urging the U.S. to scrap the tariffs and warning of damage to global supply chains and economic growth. With China facing a combined 54% tariff (34% new, plus 20% from earlier this year), the stakes are high. The European Union, hit with a 20% levy, is gearing up to retaliate—European Commission President Ursula von der Leyen promised a “strong plan” by Thursday. Italian Prime Minister Giorgia Meloni took to Facebook, calling the EU-targeted tariffs “wrong” and pleading for talks to avoid a trade war that could weaken the West.

Closer to home, Canada and Mexico—key allies and major auto suppliers—escaped the reciprocal tariff list but still feel the sting of the 25% auto duties. Relations are fraying as these neighbors grapple with a policy that upends decades of integrated trade. Last month’s tariffs on steel, aluminum, and select goods from both countries only add to the tension.

What It Means for You and Me

For the average person, this isn’t just about geopolitics—it’s about what’s parked in the driveway. Half of last year’s vehicle sales were imports, and now those cars come with a heftier price tag. Affordable options from places like Mexico or Japan might get scarcer as automakers rethink what’s worth selling here. Even U.S.-made cars aren’t immune—many rely on imported parts, and those costs will likely trickle down to buyers too.

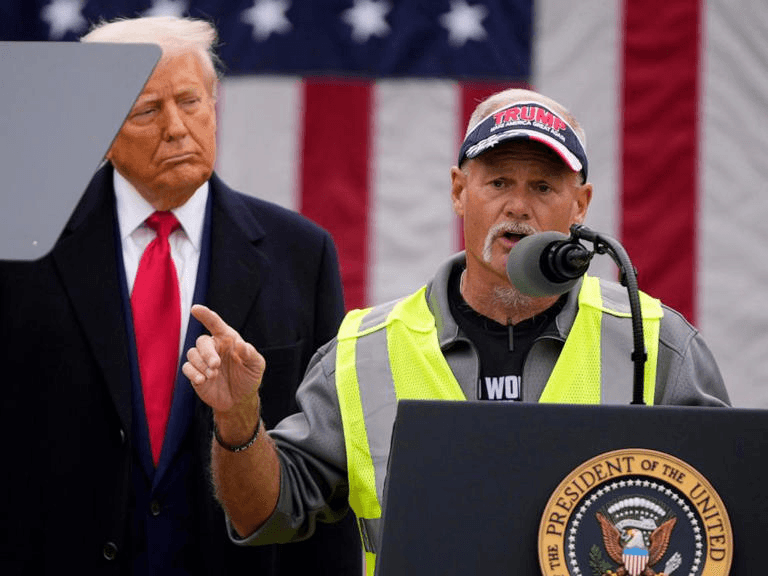

The White House sees this as a win for American workers, projecting $100 billion in annual revenue from the tariffs to bolster the economy. But there’s a flip side: higher prices could dampen demand, slow sales, and even threaten jobs in an industry already juggling a shift to electric vehicles and global competition. It’s a gamble—will companies rush to build factories stateside, or will they just pass the buck to us?

A Human Cost to a Big Idea

Trump’s vision is bold, no question. He’s betting that shaking up trade will rebuild America’s industrial might. But for now, it’s hard not to feel the weight of what’s coming. Car shopping might mean tougher choices—sticking with an aging ride, hunting for a deal, or shelling out more than planned. Around the world, leaders are bracing for a fight, markets are jittery, and families like ours are left wondering how this all shakes out.

It’s a lot to take in, and the road ahead feels uncertain. One thing’s clear: this “Liberation Day” might free up some things, but it’s tying others—like our budgets—in knots. What do you think—will this spark a manufacturing boom, or just leave us all paying more for less?

1 thought on “A Tough Day for Car Buyers: U.S. Tariffs on Imported Autos Kick In Amid Trump’s Trade Push”